By Ryan Moran

•

October 15, 2025

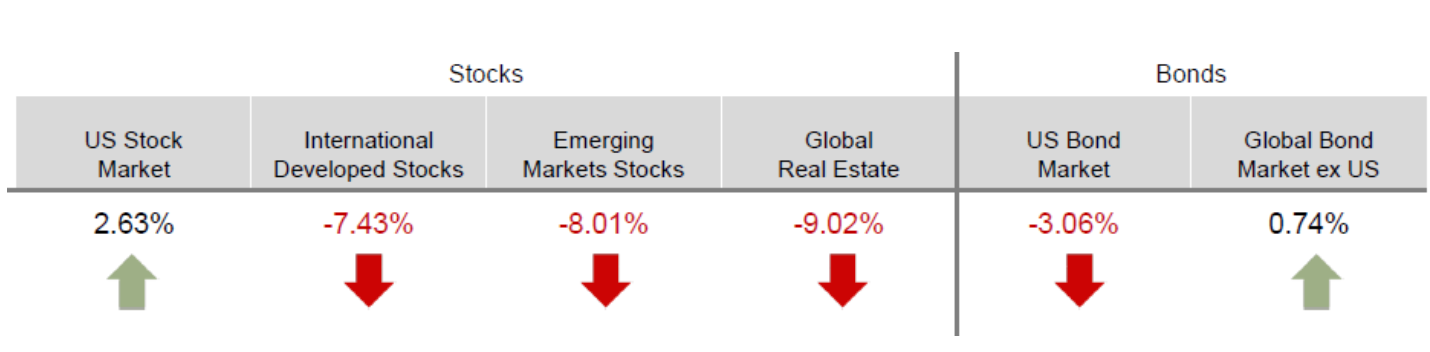

Highland Investment Advisors works best when combining financial planning with investment advice by taking a tax-aware approach. By understanding how your financial pieces can fit together, we can provide specific advice tailored to your situation. We are approaching the end of the year and there are a number of things to get done while there is still time. The following are a few things we should consider. Or contact me directly, and I can curate this list specifically for you and your family. Employer Retirement Plans – 401k Let’s look at your last paycheck stub to see how much you have contributed to your employer’s 401k retirement account. The goal is to contribute as much as possible to take advantage of the preferred tax treatment of these types of accounts. • For 2025, the maximum you can contribute is $23,500. • If you are 50 years old or older, you can contribute an additional $7,500 for a total of $31,000. • New for 2025, if you are ages 60 to 63, you can contribute an additional $11,250 for a total of $34,750. Mega Backdoor Roth Contribution via a 401k plan psst…This one is a little-known secret. Let’s review your 401k “Summary Plan Description” which contains the details of your employer’s plan. Many plans (but not all) allow for additional contributions to bring the total allowable contributions up to $70,000 (or more if aged 50 or older). This amount consists of: • your contributions up to $23,500 (either pre- or post-tax), • plus the employer’s matching contribution (pre-tax), • plus an additional “after-tax” contribution from you that can be immediately converted into a Roth 401k balance, • for a total contribution of $70,000 (or more if aged 50 or older). It is an excellent way to save more in a way that can grow in a tax-exempt Roth account, especially if you are expecting a year-end bonus. Own a business or have a side hustle? Have you set up a retirement plan for your business or side hustle? There are a number of options to consider. Let’s talk about these to see which type of retirement plan fits best with your business and objectives. It may be a way to reduce your taxable income this year while also saving for the future. Flex Spending Accounts “FSA” Many employers offer a flexible spending account that allow money to be set aside pre-tax to be used for such things as dependent care or health related expenses. However, these accounts need to be used by year-end or the funds may be forfeited. Let’s make a plan to use these dollars before it’s lost. Health Savings Accounts “HSA” If your family’s health insurance plan is considered to be a high-deductible health plan it may also be an HSA eligible plan. If so, for 2025, a family is allowed to contribute up to $8,550 into a Health Savings Account (“HSA”). These accounts are triple tax exempt(!), meaning that you first get a tax deduction for the contribution into the account, the earnings are exempt from tax, and distributions from the account for qualifying medical expenses are also tax-free. 529 Plans for Education Savings While we are saving money in a tax-advantaged way, consider saving for your child’s (or grandchildren’s) education. Earnings on these accounts are exempt from tax, and distributions from the account for qualifying educational expenses are also tax-free. Wisconsin even offers a tax deduction up to $5,130 per student. Buy a new car? The interest on loans for new cars, assembled in the United States, is tax deductible now through 2028. Itemized vs. Standard Tax Deduction One of the more significant changes to tax laws from the One Big Beautiful Bill is the increase of the amount allowed to be deducted for state and local taxes (referred to as SALT). Starting in 2025, the limit for SALT deductions has increased to $40,000, up from $10,000 previously. This may create an opportunity for you to save on income taxes by “bunching” your itemized deductions into a particular calendar year to increase the amount of your deductions above the standard deduction of $31,500 (for a married couple). It might be advantageous to pay your property real estate tax bill in 2025. Or make two years’ worth of charitable contributions this year, to take full advantage of the higher itemized limits. Or make an estimated tax payment to the state before December 31st. As always, talk to your tax professional for details. Donation of Appreciated Securities Rather than selling an investment and incurring a capital gain to generate cash for a gift to charity, consider donating that security directly to the charity. This allows you to avoid the capital gains and still receive a tax deduction for the fair market value of the securities donated. Check your Estimated Tax Payments and Payroll Withholding To avoid underpayment penalties, make sure you are on target to pay in either a.) 110% of your 2024 total tax, or b.) 90% of 2025’s estimated tax (within $1,000). Watch out for bonus payments, which may not withhold enough for taxes. Typically, they only withhold at a 22% rate, but your marginal tax rate may be higher. Effective Tax Rate and Marginal Tax Rate Your effective tax rate is the percentage of your total income you pay in income taxes. Your marginal tax rate is the percentage you pay on the next dollar of income. Many of the recommendations here help to reduce your taxable income and lower the amount taxed at your marginal tax rate. If you are in the 37%, 35%, 32%, and even the 24% marginal tax brackets, these can be meaningful savings. Tax Loss Harvesting Although equity markets are at all-time highs, you may still have positions in your taxable investment portfolio that are at a loss. Consider selling to recognize the loss for tax purposes. This loss can first be used to offset taxable capital gains generated elsewhere. Then up to $3,000 can be deducted against your ordinary income. Additional losses can be carried forward into future years. When reinvesting the proceeds, be sure to watch out for the Wash Sale Rules which could result in that loss being disallowed. Required Minimum Distributions (RMDs) Turning 73 this year? Happy birthday. You have until April 1st, 2026 to take your first required minimum distribution from most retirement accounts such as your Traditional IRA or 401k. But don’t wait that long. It may be more advantageous to start the process sooner. Roth Conversions Let’s look at your estimated income for 2025 and the marginal tax bracket you are likely in. If your tax bracket is low this year, consider converting funds from your Traditional IRA or 401k into a Roth IRA. This may reduce the amount of tax you pay over your lifetime, particularly if your projected RMDs may be significant. This technique often works amazingly well in the early years of retirement. Roth IRAs are wonderful “tax exempt” accounts that can grow tax free. Let Highland do some math for you to help quantify this decision. Premium Tax Credit for health insurance Currently, a refundable tax credit is available for the purchase of health insurance through HealthCare.gov by lowering monthly payments or claiming on your tax return. The income qualifications make eligibility and the amount of the credit quite complicated. Let’s run a projection. Harvesting Capital Gains at 0% The capital gains tax rate for is 0% for married couples, up to $96,700. Again, let’s look at your estimated income for 2025. Maybe this is an opportunity to make your investment portfolio much more tax-aware. Watch out for capital gain distributions! Certain investment structures, like mutual funds and some ETFs, distribute income annually to shareholders. This can trigger taxes (unnecessarily in my opinion). This may be a good time to change your portfolio to a more tax-aware approach. Make Tax-Aware Investment Decisions Let’s review where your investments are held to minimize the tax drag. Keep tax efficient assets, like ETFs and index funds, in your taxable account. Higher income and active strategies are better kept in tax-advantaged accounts. Depending on your marginal income tax rate, tax exempt (or double tax exempt) municipal bonds may be advantages. Rebalance your Portfolio Strong returns may have tilted your investments towards more risk than you may be willing to accept. But let’s be thoughtful about rebalancing before incurring capital gains in a taxable account. Reallocations in tax advantaged accounts may be more efficient. Create a Plan for 2026 and 2027 Cash Needs The “distribution” phase of your financial life involves living off the investment portfolio you spent your life accumulating. Plan out your spending needs for the next couple of years, and match this to your investment strategy. While your nest egg still needs to grow, don’t take unnecessary risks with your spending cash. It may reduce anxiety when markets get volatile. Stop accumulating cash in your checking account Yields are still attractive, especially compared to what little is offered in a checking account. While this may seem overwhelming, Highland Investment Advisors can help you simplify this. We understand how each of these pieces fit together and customize our advice to your situation. This commentary should be considered informational only and should not be considered tax or investment advice. It is recommended that you speak to a tax and/or investment professional directly to determine how this may impact your situation.